Table of Contents

~~~~~~~~~~ Super Outdated, for my reference only ~~~~~~~~

Basic IRAS - Tax Information

- If you have hard time read IRAS webpages or my wiki, or not good at doing research, just call IRAS hotline on that part (1800 356 8300)

- time: peak hours are from 10am to 2.30pm

- Mondays to Fridays: 8 am to 5 pm for all enquiries

Saturdays, Sundays and Public Holidays : Closed

How Tax Works in SG

- First, you will/or if you will receive notification to file income tax return;

- Tax Return definition: tax report forms that contains information that Gov needs to calculate your tax

- if you are under “Auto-inclusion scheme (AIS)“ (which means, your boss will file tax return for you) AND you did receive a message from Gov about you are “under Non-filing Service”, then you can skip the first step.

- Second, Update and Submit you tax reliefs and rebate information on http://mytax.iras.gov.sg (Before Deadline Date: for 2016 case, it is April 18 for online filing, April 15 for paper filing)

- Very Important, as the Tax information are Provided by both Your Boss and Yourself, since no one knows you have some personal family reliefs but Yourself

- Here are the steps:

- Login in myTax Portal with SingPass

- under e-Service For individual Income Tax on left panel > “e-File Form B/B1”

- click in and read through the ready-filled information

- refer to relief as I wrote about below to fill in the other reliefs

- Most Important: Child Relief and Parenthood Tax Rebate if You Got New Born Child (Detail explained below)

- Enter your new child information, detail refer to the website link below I wrote

- Click on Parenthood Tax Rebate at below of the page above the submit button, it will bring you to a new page to enter child information needed, once finish, click the button below to confirm and back to main form page

- After relief information done, then confirm and submit the tax form using buttons at bottom of the page.

- Done

- Third, later, you will receive “Notice of Assessment (NOA)” (basically the “Tax Bill”)

Tax Structure

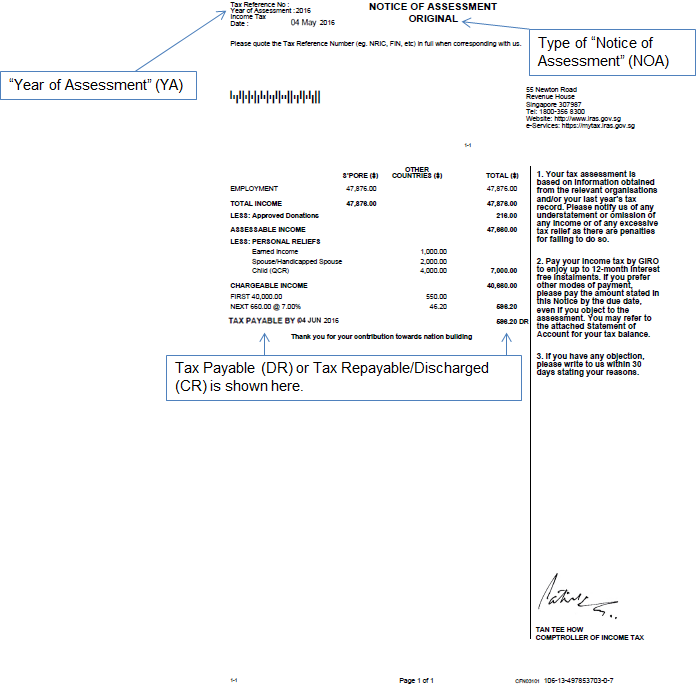

sample look of notice of tax assessment

structure of tax

(ref: https://www.iras.gov.sg/irashome/Individuals/Locals/Paying-your-taxes-Claiming-refunds/How-to-Read-Your-Tax-Bill/) (ref: https://www.iras.gov.sg/irashome/Individuals/Locals/Working-Out-Your-Taxes/What-is-Taxable--What-is-Not/)

- Your taxable total income

- - Donation

- - non-taxable relief credits (basically Gov won't tax some important spending inside your income)

- like child relief …

- = your rest part of income that needs to be taxed

- First 20k income = 0 SGD tax

- Next 10k in 2%

- Next 10k in 3.5%

- Rest x 7% = rest tax

- final tax bill = above - rebates balance (like Parenthood rebate)

- (left over rebate balance can be used in next year)

- detail version (Year of Assessment (YA) = current year, assessment is previous year Jan-1 to Dec-31)

- Total Income = trade income (accounting year) + employment income + rental income + etc.

- Assess-able Income = Total Income - Approved Expense - Approved Donation

- Personal Relief = sum (reliefs)

- Tax-able Income (charge-able income) = Assess-able Income - Personal Relief

- Pay-able Tax = Tax-Formula (Tax-able Income)

- Pay-able Tax bill = Pay-able Tax - Tax Rebate balance (all rebates)

- Tax-Formula: (<20%)

- Apply to

- SG citizen

- SG PR

- Foreigner worked or stayed > 0.5 year (excluding directors of company)

| Progress amount | rate | actual tax amount | year income | monthly | total tax |

|---|---|---|---|---|---|

| 20k | 0% | 0 | 20k | 1666 | 0 |

| +10k | 2% | 200 SGD | 30k | 2.5k | 200 |

| +10k | 3.5% | 350 SGD | 40k | 3.3K | 550 |

| 7% | 50k | 4.1k | 550+700=1250 | ||

| 7% | 60k | 5k | 550+1400 = 1950 | ||

| 7% | 70k | 5.8k | 550+2100 = 2650 | ||

| +40k | 7% | 2800 SGD | 80k | 6.6k | 3.3K |

| 11.5% | 90k | 7.5k | 3350+1150 = 4500 | ||

| 11.5% | 100k | 8.3k | 4500+1150 = 5650 | ||

| 11.5% | 110k | 9.1k | 5650+1150 = 6800 | ||

| +40k | 11.5% | 4600 SGD | 120k | 10k | 8k |

| +40k | 15% | 6000 SGD | 160k | 13k | 14k |

| +40k | 17% | 6800 SGD | 200k | 16k | 20K |

| +120k | 18% | 21.6K SGD | 320k | 26k | 42k |

| extra | 20% |

(ref: https://www.iras.gov.sg/irashome/Individuals/Locals/Working-Out-Your-Taxes/Income-Tax-Rates/)

Python code for calculation

tdata = [(20000, 0),(10000, 0.02),(10000,0.035),(40000,0.07),(40000,0.115),(40000,0.15),(40000,0.18),(40000,0.19),(40000,0.195),(40000,0.20),(320000,22)] total = 7000*12 rest=total t=0 for i,data in enumerate(tdata): print(rest) if rest<data[0]: t+=rest*data[1] print(rest*data[1]) rest=0 break else: t+=data[0]*data[1] print(data[0]*data[1]) rest = rest - data[0] print(t)

Element: approved expense

- Category: Deductions for Employees

- travel expense from own income

- entertainment expense from own income

- subscription expense from own income

- other and ref:

- Category: Deductions for Sole-Prop, Self-Employed, Partnership

- Biz Expense

- Productivity and Innovation Credit (PIC)

- renovation and refurbishment works

- fixed assets capital allowance (CA)

- medical expenses

- R and D

- land building

- Pre-Biz expense

- lose and allowances

- detail ref:

- Category: Deductions for Rental Expense

- loan

- property tax

- insurance

- repairs

- maintenance

- commission and legal

- management

- furniture

- internet

- utility

- other and ref:

Element: approved donation and investment

- donation = (2.5~3) * donation

- cash

- shares

- computer

- art

- land and building

- other and ref:

- Angel Investors Tax Deduction Scheme (AITD)

- invest > 100K on start-up for 12 month and hold 2 years

Element: reliefs and rebates

- relief = minimum (total reliefs, 80K)

- Purpose: promote specific social and economic objectives

Common Reliefs

- Course Fee relief

- requires course with “a recognised academic and professional qualification” or “SG registered entity with ACRA”

- or relevant to your current work or new work

- Will Not Eligible for general or basic skill or hobby or language or non-previous-work-experience

- max to 5.5K per year, useful for course fee, test fee, registration fee, tuition fee.

- CPF cash top-up relief (Automatically Claimed)

- cash top-up to your CPF Special account;

- relief = minimum(top-up, 7000 SGD)

- Condition: SA sum ⇐161k

- cash top up to your Parent/Grandparent/Sibling/Spouse's CPF Special account

- Condition: Target's annual income Must < 4k, that is monthly 333 SGD

- relief = minimum(top-up, 7000 SGD)

- Condition: SA sum ⇐161k

- CPF relief (Automatically Claimed if you under Auto Inclusion Scheme)

- basically means your CPF part out from income will not be taxed

- IF employee, THEN condition: your employee CPF monthly contribution MUST < 5K, 6k; False: Can't claim

- IF self-employed, roughly same idea, also apply to addition medisave contribution

- Earned Income Relief (Automatically Claimed)

- amount is 1000 SGD for the year, basically means you got some spare cash that Gov don't want to tax you that hard.

- Life Insurance Relief

- basically, you payment bill cost on insurance will not be taxed.

- Condition: yearly CPF contribution MUST < 5k, means, your yearly income roughly < 5k / 20% = 25k, that is 2k per month.

- NSMan relief (automatically claimed)

- 3000 SGD for the year for man, 750 SGD for wife, 750 SGD for each parent

- Parent relief

- 7000 SGD per parent for the year if stay together (detail refer to link)

- Condition: parent > 55 or ill

Additional Reliefs

- Child Relief (Once fill once, Gov will remember)

- 4000 SGD per child for the year, shared between parents

- Spouse Relief

- 2000 SGD for spouse, Condition: spouse yearly income < 4k, that 333 SGD per month

- (female only) maid relief

- (female only) grandparent relief

- (female only) Working mother child relief

Additional Rebate

(Rebate is like one-time credit, it can be used to actually pay the final tax bill, unlike relief, as relief can repeatably help you reduce each year's tax calculation.)

- Parenthood Tax rebate

- 1st child, 5k rebate; shared between parents

- 2nd child, 10k rebate; shared between parents

- 3rd- child, 20k rebate; shared between parents

Detail: Child Relief

- official Claim steps:

- Go to Main Tax Form

- Go to item 6-22 “Total Deductions And Reliefs”

- Click on “Change, remove or make new claims for Deductions, Reliefs and Rebates (e.g. Donations, CPF, spouse relief, child relief and Parenthood Tax Rebate)”.

- Go to item 9 “Child”. Under the Child Order column, enter the order of child. (For order, 1st child is 1, 2nd child is 2; if you have “Complex” family, check the refer link as I wrote in above section)

- Select Identification Type and enter Identification Number of your child.

- Under the “Type” column, enter Q (for QCR as normal child) or H (for HCR as disabled child).

- Enter your claim amount.

Detail: Parenthood Tax Rebate

- official updated Claim steps:

- Go to “Main Tax Form” (basically the “e-filing B/B1” link on the left panel)

- Go to item 6-22 “Total Deductions And Relief”.

- Click on “Change, remove or make new claims for Deductions, Reliefs and Rebates. (e.g. Donations, CPF, spouse, child reliefs and Parenthood Tax Rebate)”.

- Go to item 22 “Parenthood Tax Rebate (For NEW Claims Only)”.

- Click on “Claim Parenthood Tax Rebate for a newborn child for the first time.”

- Enter the percentage of Parenthood Tax Rebate as agreed between you and your spouse.

- Enter the order of child under the Child Order column (For order, 1st child is 1, 2nd child is 2; if you have “Complex” family, check the refer link as I wrote in above section)

- Enter the child's Singapore Birth Certificate number.

- My previous old way of claim by following the officer's steps are:

- go to myTaxPortal > left-side menu > Contact IRAS : myTax Mail

- use myTaxMail to email them, with your content and with your 3 attachments:

- content: about parenthood rebate, family IC, rebate distribution bet parents,

- attachment: marriage cert, child birth cert, distribution bet. parents with signiture

- wait for the reply

- website guide steps:

Oversea income

- basically, no need to declare or be taxed

If your employer is in the Auto-Inclusion Scheme

- Things become different if your tax filing is done by your employer, based on what I checked, those tax rebate and dedication part you still have to do it yourself.

- so, that is why this part is the research I did to step through the process

What is Auto-Inclusion Scheme

- In this scheme, employee (most likely you) don't have to manually submit income tax assessment (basically some forms about your incomes) to IRAS; as their boss (employer) submit for them electronically already before tax submission date.

- Tax Return definition:

- Employees do not need to file their income tax returns only if:

- They received a No-Filing Service (NFS) letter from IRAS; and

- They do not have additional income to declare; and

- They do not need to make changes to their tax relief claims.

Questions on Estate tax

- question: some says foreigners are subjected to estate tax on the amount in the the portfolio exceeding USD60k, therefore it is advisable to create joint account w. family, so easier for family withdraw money after pass away.

- how much estate tax, account after death

Questions and Answers

1. How to Distribute "Parenthood Tax Rebate" and "Child Relief" between Husband and Wife

- situation: soon or later, sometimes miscommunication between wife and husband, the Gov sends a tax review saying your family total relief claimed exceed the max allowed amount, then you need find why and how and what to do. here is the study I worked.

Answer

- Top Factor:

- tax bill is yearly bill, means every year it will charge you once

- Pre-factor-to-consider A:

- Parenthood Tax Rebate is like = Virtual Money given to your family if you have made a child

- First Baby = 5000 virtual SGD

- Second Baby = 10,000 virtual SGD

- Rest Baby = 20,000 virtual SGD each

- Thus, you know, your kid is not worth much money in term of virtual money that Gov gives to you to pay tax bill.

- Once you used up them, then it is gone. so if both husband and wife yearly tax bill are like 1000sgd each, then one child can only free your tax bill for 2.5 years.

- Final result Part A,

- In long term view, so no matter how you distribute Parenthood tax rebate, as long as you consider both wife and husband are making money for the whole family, and don't want to AA and leave like separate persons with own private income, then, the parenthood tax rebate distribution are not that important, as they will in the end save the same amount of money down the load.

- In short term view, if considering current cash flow, and minimize actual cash out payment in tax during recent 5 years, then of course, make sure both wife and husband have some parenthood tax rebate amount in one's tax account. Which means, no one need to pay hard cash in first a few years. and you can shift and transfer that virtual money between wife and husband anytime. so distribution is best based on ratio of each one's final tax bill; it can be done anytime like “tax” bank transfer.

- Pre-factor-to-consider B:

- Child Relief is like a ”- Amount” Constant in your “total Family” chargeable tax formula, and it is Always a Constant value in that formula (as long as your child is still technically as “child”, not a “Grown-up adult”)

- that constant value = - 4,000 SGD * your child count

- eg. if you got 2 kids, that constant value = - 4,000 * 2 = - 8,000 SGD

- So How much is (for example with 2 kids) - 8,000 SGD means in your Tax formula, (here ignore your spouse for a moment, and you take all those -8,000 in your own formula <100% of child relief> and leave -0 for your spouse <0% of child relief>)

- let me make this simple to understand,

- imagine you earn 3000 SGD per month, and yearly income roughly = 3000 * 12 = 36,000 SGD,

- minus the non-taxable 20% CPF part, your still have like roughly 28,000 SGD in the formula

- minus the 1000 sgd all-people-get-it relief, roughly 27,000 SGD in the formula

- since the first 20,000 is tax free, so you have 7,000 SGD still left counting in as tax chargeable income,

- so that - 8,000 SGD will zero out your tax chargeable income, making your tax bill = 0, still got 1000 SGD child relief extra for your spouse to use in one's own tax formula.

- thus if both you and your spouse earns more than 3000 SGD per month, and if the wife and husband don't bother AA and working for family as one person. It really doesn't matter who take all the relief. since they will fully utilize it. Also note, wife has extra relief like working mother relief and etc, which only usable for wifes, so calculate a bit out on who use how much percent.

- however, if either one earns less than 3000 SGD per month, then the less income one should only claim whichever percent of the relief to zero out the chargeable income, let the spouse claim rest percentage of relief to reduce a bit chargeable income

- Thus the final result Part B is,

- just let the big money earning one take all the 8000 SGD, provided wife and husband don't live like strangers.

- Since you can only waste that relief if you have Zero income and still want to put that -8000 SGD in your chargeable tax formula, that chargeable tax will around to zero if it is a negative amount. Like wasting a million dollar missile to kill a ant instead of destroying a massive zombie attack towards your big income earning spouse, just no worth it.